These surface properties’ alternations range from optical changes, including antiglare (AG) or antireflective (AR) coatings, to wetting modifications, such as antifingerprint (AF) and self‐cleaning coatings, to even functional changes such as antimicrobial coatings. The vast array of coatings tailor surfaces to penetrate niche markets and satisfy strong customer preferences. Here, we describe market changes in topical coatings and the market forces that govern them.

Ongoing Evolution as Market Forces Renovate

AG and AR coatings experience constant innovation and product updates. Original AR coatings began with single‐layer AR films, which were designed to lower the refractive index (RI) of glass down to 1.22. These were often magnesium fluoride (MgF2)‐deposited films.3 And although multilayer AR coatings were used on CRTs decades ago, more recently the trend is to use such coatings on touch panels, so that the coatings are sputtered via multilayer deposition. These multilayer AR coatings often comprise 5–10 layers of two materials with considerably different refractive indices, spaced at half the wavelength of light. This spacing and difference in RI causes the light to bounce between the layers and cancel, or interfere, with incoming light and neutralizes reflection. These coatings often have RIs around 1.0.4 AG coatings, on the other hand, work by scattering light, as opposed to lowering refractive indices. The theory is that the light wavelengths will completely scatter incoming light and prevent profuse reflection from the viewer.5

There are primarily two methods to achieve effective AG. One method involves acid etching the glass to create the proper surface roughness. The other is to use a spray‐on coating, which usually contains matte‐inducing silica particles embedded in a polymer network. Although they work quite well in this regard, AG coatings tend to be hazy and generally reduce the display’s visual quality. This is because there is an inverse relationship between glare reduction and resolution. As the gloss decreases, diffusion increases—but this leads to higher losses of display resolution. As a result, we see significant demand from original equipment manufacturers (OEMs) and consumers to improve AG coatings’ quality. In some cases, OEMs use AR coatings and AG glass simultaneously to provide dual functions. This is common in outdoor display glass, such as automotive central navigation systems. Nonetheless, many OEMs are still unhappy with their level of performance and cost. The market quickly will adopt improvements that increase display resolution and reduce reflection while eliminating expensive deposition techniques. Thus, opportunity abounds for new entrants (with cost or performance improvements) to gain a substantial market share.

QUICK TAKE

With the advent of COVID‐19, there has been a re‐emergence of customer demand for antimicrobial and antiviral coatings. Approaches that combine antimicrobial or antiviral efficacy into invisible fingerprint and antifingerprint coatings should quickly gain market share.

On the surface property side, AF coatings, also known as easy‐to‐clean coatings (ETCs), existed even before handheld mobile devices became mainstream. These highly oil‐resistant coatings first made their mark in the optical lens market, offering eyeglass wearers an easy‐to‐clean solution. As smartphones emerged, a leading global Japanese chemical manufacturer (Daikin) was in prime position to take market share and establish dominance.6 This dominance has prevailed for the better part of 15 years, with others vying to gain market share in this rapidly growing and highly profitable market segment. Today, there are dozens of AF coating manufacturers, including PPG, Solvay, Shin‐Etsu, and 3M. Despite the abundance of competitors, Daikin has maintained a commanding market share.7 Their continued success has been driven by a steadfast approach to engineering with a focus on coating durability, relationships with key customers, and supply chain and production innovation.

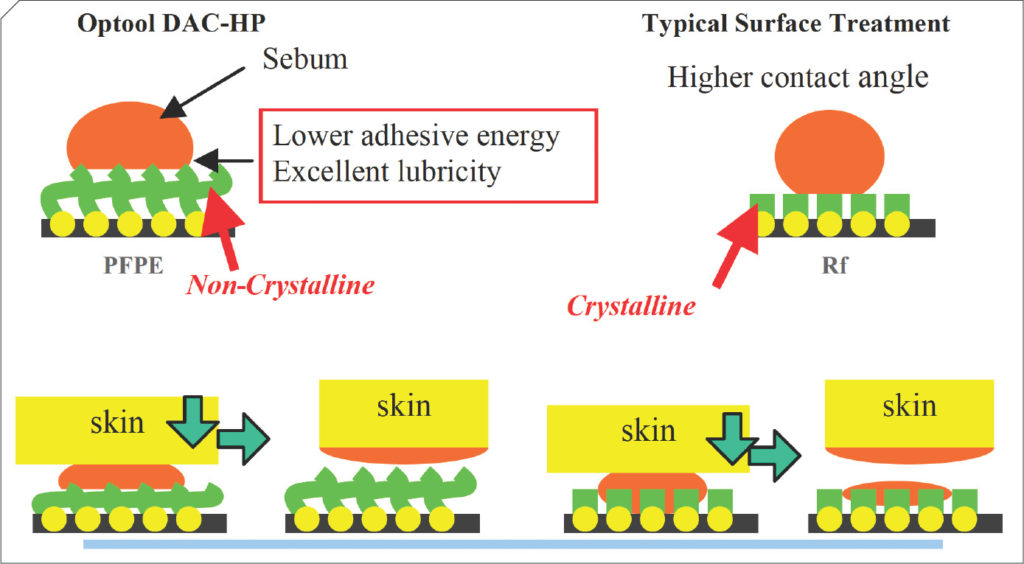

AF coating technologies leverage the highly oleophobic characteristic of fluoropolymers. Fluoropolymer AF coatings, which are based on perfluoropolyether (PFPE) silane technology, are applied to display glass using a spray or PVD process, resulting in a low‐energy surface that is highly oil and water‐resistant. The theory is that a high molecular weight non‐crystalline polymer is adhered to the glass, creating a smooth, impenetrable surface that prevents the fingerprint oil from absorbing into either the substrate’s coating or micro‐texture. The low surface energy also causes the fingerprint oil to “bead up,” making it “easy to clean” upon wiping with a dry cloth. Meanwhile, the PFPE’s silane moiety binds covalently with the glass to create a uniform monolayer. This results in a coating with a less than 10‐nanometer (nm) thickness. A common misconception is that having oleophobic properties is enough for a suitable AF coating. As mentioned earlier, a key function of PFPEs is that they are also non‐crystalline fluid polymers. This property creates an ultra‐smooth layer that prevents oil from embedding into the coating.

Fig 1: illustrates this in comparison with other crystalline oleophobic coatings.

Compared to typical surface treatments, perfluoropolyether (PFPE) silane technology is a non‐crystalline oleophobic treatment. This trait keeps oil from embedding into the coating, making it smooth and impenetrable.

An Invisible Option Emerges

Despite the success of AF coatings, the display market is ripe for innovative solutions that reduce the visual disturbances that a fingerprint creates. With touchscreens’ proliferation (such as mobile devices, laptops, tablets, kiosks, point‐of‐sale terminals, and automotive and aerospace displays), this need has only increased, as has the need for antimicrobial protection of high‐touch surfaces.

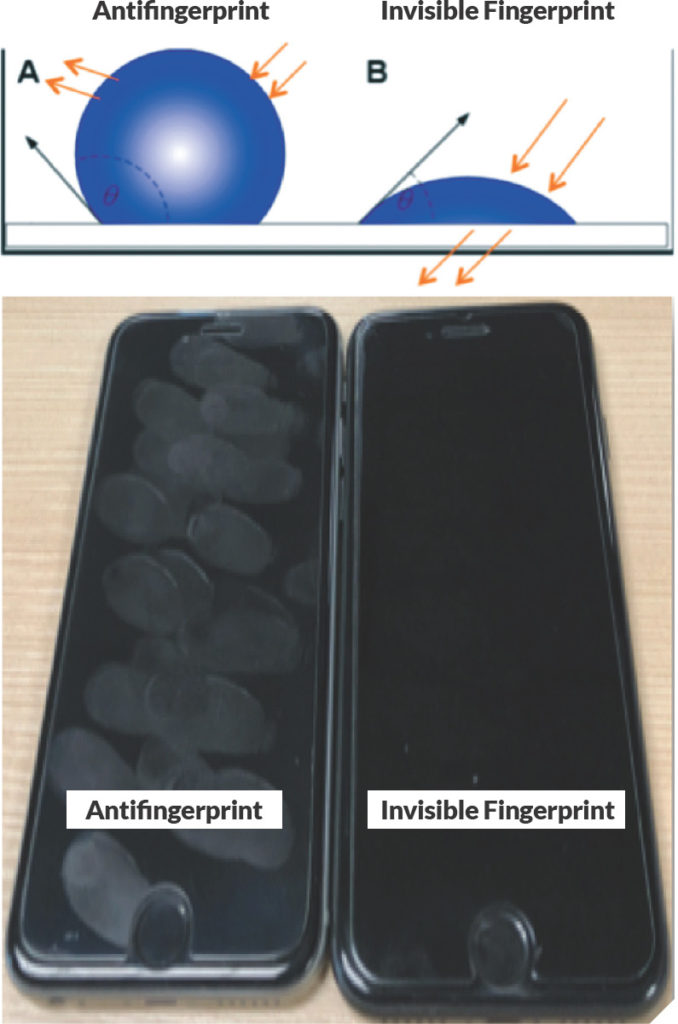

One unique approach that is gaining traction, invisible fingerprint coatings (IF), adopts a technique that is the opposite of conventional AF coatings. Instead of creating an oleophobic surface, IF coatings use specialized chemistry to create a durable oleophilic surface on glass that causes oils from fingerprints to spread along the surface. This spreading effect allows light to pass through the fingerprint and glass substrate without refraction or reflection, creating an optical illusion that the fingerprint is not present. A robust oleophilic IF coating that is also similar in RI to fingerprint oil (generally felt to be between 1.33 and 1.55) will hide fingerprints 10 times better than leading AF coatings.

Figure 2

Top: A robust oleophilic invisible fingerprint (IF) coating hides fingerprints 10 times better than leading antifingerprint (AF) coatings. Bottom: A real‐life comparison between IF and AF coatings.

All other figures courtesy of the author.

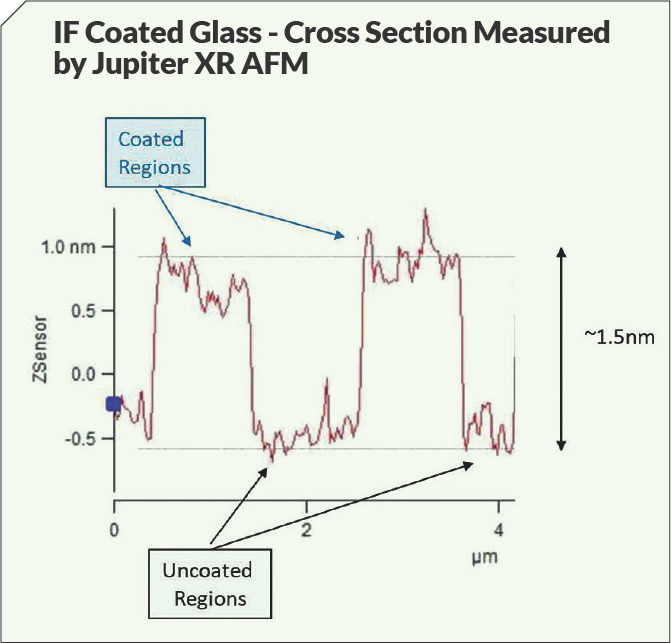

Similar to state‐of‐the‐art AF coatings, IF coatings also have alkoxy silane moieties. This is critical to market adoption, as there are two key characteristics that must be met for customers to switch from AF to IF outside of just‐improved fingerprint hiding. First, IF coatings must be compatible with the existing spray or physical vapor deposition equipment already installed for glass coaters. Despite improved performance, market penetration of IF coatings would be significantly delayed or diminished if customers had to invest in new capital to apply IF coatings. Second, IF coatings must demonstrate equivalent or better durability than existing AF coatings. Durability is commonly demonstrated by measuring the change in the coated surface water contact angle before and after abrasion. State‐of‐the‐art AF coating water contact angles usually drop approximately 20 to 30 degrees after 1,500 cycles of pencil eraser abrasion using a linear abrasion machine. The silane moieties in IF coatings enable a similar level (or in some cases, an increased level) of durability, so that customers can switch technologies without any sacrifice in durability. Moreover, a silane‐based IF coating (Fig. 3) will result in a true monolayer with a thickness of less than 3–5 nm. Such thicknesses ensure there is no haze or loss of transparency of the glass substrate. Last, a significant advantage of IF coatings is that they are inherently fluorine‐free. As much of the world transitions from fluorine, and large electronic OEMs push to create more environmentally safe products, switching from fluorine‐based AF coatings gives brands an avenue to continue along in concert with their environmental goals.

Figure 3

A silane‐based IF coating creates a true monolayer that is less than 1–3 nanometers thick.

All other figures courtesy of the author.

NBD Nanotechnologies (http://www.nbdnano.com) offers its first‐in‐kind silane‐based IF solutions marketed under the InvisiPrint® trademark that provide consumer electronics brands a new avenue for continued product and marketing innovation. In fact, Frost & Sullivan recently recognized NBD’s IF as their new product of the year in the AF market, as it meets all the criteria for widespread market adoption.

New Uses Surface for Antimicrobial and Antiviral Coatings

Antimicrobial coatings are the latest in innovative coatings for the glass display market. With the advent of COVID‐19, there has been a re‐emergence of customer demand for antimicrobial and antiviral coatings. For glass technologies, there are primarily two methods to impart antimicrobial properties with greater than 99 percent bacterial reduction.

One approach involves infusing silver nanoparticles into the glass, and there are mainly two techniques for doing so. The first requires sintering silver particles onto glass. The other, called ion exchange, chemically infuses the silver.8, 9 Both of these methods produce highly durable coatings, which can still be overcoated with IF or AF coatings. Silver acts as a broadband antimicrobial by reducing the solid silver particles into silver ions. These silver ions then can diffuse into the bacteria’s cell membrane, causing cytotoxic stress during numerous biochemical pathways, primarily DNA denaturing and reduced protein‐DNA adhesion. Although these approaches work well to reduce bacteria and offer a surface for IF or AF coatings to bind to, they tend to be expensive to produce because they require two coating steps to achieve both AF or IF and antimicrobial properties.

The other approach involves coating the glass with a cationic polymer such as quaternary amines. These cationic polymers kill bacteria on contact by disrupting their cell membrane. This approach’s drawback, however, is that it is less durable and is often ineffective at killing certain gram‐negative bacteria.10 Despite this limitation, because of the demand for “safer” touchscreens along with this approach being a lower‐cost solution, quaternary amine polymers have seen recent success in the marketplace.11

Finally, there are emerging approaches to combine antimicrobial or antiviral efficacy into IF and AF coatings. The advantage of this approach is two‐fold. The OEM benefits with a simple, low‐cost spray‐applied process and the consumer benefits with a safe and visually appealing display. A target mechanism is to combine silane‐based antimicrobial moieties, along with AF or IF coatings. The trend of combining product features in a single coating enables higher market adoption, and appeals to coaters and OEMs, as costly multiple‐coating steps can be avoided.

NBD Nanotechnologies is targeting the launch of a hybrid IF/AM coating in early 2021 to address these growing market needs. A novel spray‐applied coating that can be cured with mild thermal conditions, it yields a greater than four log reduction (99.999 percent) in microbials with good durability. Given the mild cure, this approach will be viable for both glass and plastic substrates. And, unlike other approaches that require sintering or chemical ion exchange, it will be highly scalable and cost‐effective. The next steps to finalize this product’s commercialization are to fine‐tune the processing parameters, affirm antiviral efficacy, and engage display coaters to pilot the process at commercial scale.

So, the next time you are fortunate enough to visit a restaurant and place your order on the tablet at the table, go to the gym, or make an in‐store purchase, you will benefit not only from a visually appealing screen, but also the fact that you are protected from the previous customer’s germs.